Table of Content

You can apply for a pre approved home loan which is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. Generally, pre-approved loans are taken prior to property selection and are valid for a period of 6 months from the date of sanction of the loan . Home loan providers usually charge a processing fee around 0.5% of the loan amount to be availed. Choose a home loan provider who is transparent w.r.t. processing fee and other related charges. SURF offers an option where the repayment schedule is linked to the expected growth in your income. You can avail a higher amount of loan and pay lower EMIs in the initial years.

Currently, HDFC Home Loans are available at a Floating Rate of Interest. This interest rate prevails at the time of the loan sanction. The application process is completed by clicking on the “Submit” button.

Home Loan Floating Interest Rate Card for Women –Special Current Offer p.a.

Gift yourself and your loved ones the home you have always wished for by availing HDFC Reach Home Loans . The mortgage approval is a binding document which certifies that your lender will support you with the funding. Search across Germany's property platforms to find the perfect property for you. The Reserve Bank of India raised the repo rate by 0.35%, from 5.9% to 6.25%, at its monetary policy meeting on December 7, 2022. The RBI will be compelled to employ the interest rate hike option, in addition to other measures to control inflation, till inflation falls below its comfort level. The nature and specifications of the property such as the age of the property, its size, its location, whether approved by the government or not, etc.

The hike follows a similar 35 basis points hike by the Reserve Bank of India in its monetary policy review earlier this month. The HDFC Home Loan interest rates above are linked to RPLR or HDFC’s BenchMark Rates. IRDAI is not involved in activities like selling insurance policies, announcing bonus or investment of premiums. Public receiving such phone calls are requested to lodge a police complaint. Headquartered in Mumbai, HDFC Sales was formed in January 2004.

Combination Loans

The earlier the better, HDFC home loan for salaried and self-employed is 21 years. The early you start longer the repayment tenure you may get and the lower the EMI as well. It should be noted here that the maximum age by which one has to pay back the loan is 65 with a maximum loan tenure of 30 years. This means the tenure will be longer or shorter depending on your age at the time of loan disbursement. The hike in rates will be applicable for both new as well as old customers.

Also, borrowers who are salaried employees can also get reduced rates than those that have a business or are self-employed. If you are a working individual and wish to have a home of your own, you can do so by availing the HDFC Reach Home Loan. If your annual income is Rs.2 lakh and above, you can avail this home loan at attractive rates of interest starting at 8.75% p.a. For home loan approval, you need to submit the following documents for all applicants / co-applicants along with the completed and signed home loan application form.

Home Loan Recommended Articles

The customer shall pay the premium amounts directly to the insurance provider, promptly and regularly so as to keep the policy / policies alive at all times during the pendency of the loan. Once you've selected your mortgage offer, we will provide you a document checklist that shows all the required document you need to submit. Like many mortgage brokers, we get paid by the German lender banks. Unlike many brokers, we won't charge you any fees for our services.

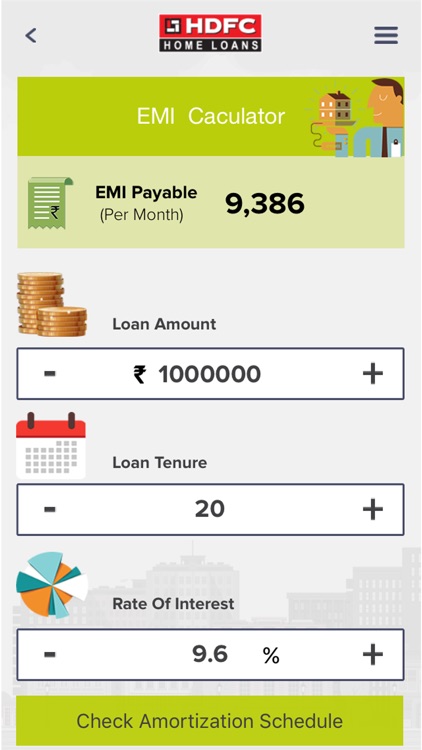

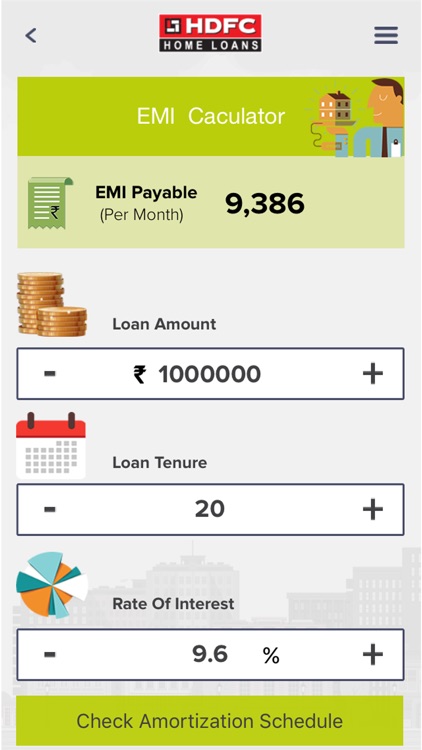

For all other Home Loan products, the maximum repayment period shall be up to 20 years. Improve your credit score by creating a reasonable track record of timely repayments so that you achieve a high credit score which would improve your prospects of getting a home loan. Interest rates on home loan are lower than other types of loans. Check your loan eligibility before starting your home loan application. With unique loan appraisal techniques and flexible eligibility norms, HDFC makes it easy for you to avail a home loan by assisting you with the entire loan process.

The loan funds up to 90% of the property value depending on the amount. The loan is extended to purchase a plot through direct allotment, and that is offered for resale. The home loan funds up to 90% of the property value depending on the loan amount.

Every information regarding ongoing mortgages of the applicant or his/ her own business unit including the due amount, repayments, security, objective, balance loan tenure among others. Customers can take this option by paying a nominal fee and choose between, either reducing your monthly instalment or loan tenure. The maximum repayment tenure depends on the type of housing loans you are availing, your profile, age, maturity of loan etc. For your convenience, HDFC offers various modes for repayment of your house loan. To find the right mortgage, there are some points you should consider.

These include, for example, a very good credit rating, a very high income, and an excellent location of the property. We compare the best mortgage rates in Germany for the top 750 lenders. Home Development Finance Corporation Ltd has hiked its Retail Prime Lending Rate by 35 basis points with effect from December 20, 2022.

Enjoy substantial tax savings through exemptions allowed for the Principal and Interest repaid in a financial year under various sections of the Income Tax Act, 1961. Avail of a pre-approved loan with an in-principle sanction even before the property has been identified. The Floating rate is termed Adjustable in HDFC Bank benchmarked to RBI Repo Rate. The HDFC Prime Lending Rate or the Benchmark Rate is derived by adding a premium spread. List of Directors and stakeholders certified by a Chartered Accountant or CS if the business unit is an organization. Any kind of incidental expenses will be paid to cover the charges, costs and expenses that might have been spent to recover dues from a customer.

Your loan amount taken or sanctioned by the bank affects your interest rates. If a higher loan amount is taken, it has a higher rate of interest. This will be done on a daily reducing balance method at monthly reset periods.

No comments:

Post a Comment